One of the key learnings after the Sub Prime Crisis (2008) was to book profits at regular intervals. However, it isn’t the easiest thing to do. It requires some bit of thinking and discussion. Profit Booking means tracking the portfolio and acting at regular intervals. It is contrary to the popular practice of: buying and forgetting until you need the money. Moreover, if profit has to be booked some pertinent questions needs to be answered:

- At what profit percentage should profit booking be done? What about the consequential exit loads and capital gains?

- Should performance be tracked at an individual fund level or at a portfolio level?

- What should be done with the money once profit booking is done?

These aren’t the easiest questions to answer and they surely do not have one single answer to suit all.

At what profit percentage should profit booking be done?

This should be mutually discussed between the RM and the client. For some clients, 10% is good enough while others prefer a 15-20% return before it can be booked.

Also, duration of holding the investment matters. While 10% per annum is low for some clients, if holding period has been more than a few years but the same 10% is good enough if it is coming within a year of investment.

What also matters is the nature of the fund from where the returns are coming. If the inherent nature of the product is risky then the expected return percentage would be higher as compared to a less risky product. For example: If a large cap mutual fund is giving 10% return in a year’s time, it is good, however if it is coming from a PMS or a mid-cap mutual fund then it isn’t exciting enough. So, the risk reward parameter needs to be evaluated before doing the profit booking.

Exit Loads and Capital Gains

Most mutual funds have exit loads except liquid funds and some other short duration debt funds. The exit load may be applicable for 1 to 3 years depending on the type of the mutual fund. Any exit from the mutual fund during this time would invite a penalty of 1% on the total fund value. While booking profits, it should be a general thumb rule that net of charges and taxes the profit percentage is significant enough. Like in the above example 10% within 1 year may appear a good profit if it is from a large cap fund, however that 10% would be more attractive if it is nett of exit load and taxes.

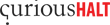

Capital gains are the taxes on profits. There are 2 types of taxes applicable on mutual funds – short term capital gain tax and long-term capital gain tax. The duration of short term and long term varies in debt and equity fund. Paying capital gains tax is imperative however investor may want to evaluate the timing of redemption. If short term gains can be converted into long term gains by waiting for a few weeks or months, then the wait is worthwhile in most cases.

Some other reasons for doing Profit Booking

- There is change in the fund manager for the funds which are doing well.

- There is a strong negative view about a particular sector where the funds are invested

- A financial goal is supposed to be met within 5 years

- Weak overall global sentiments with no positive news in sight

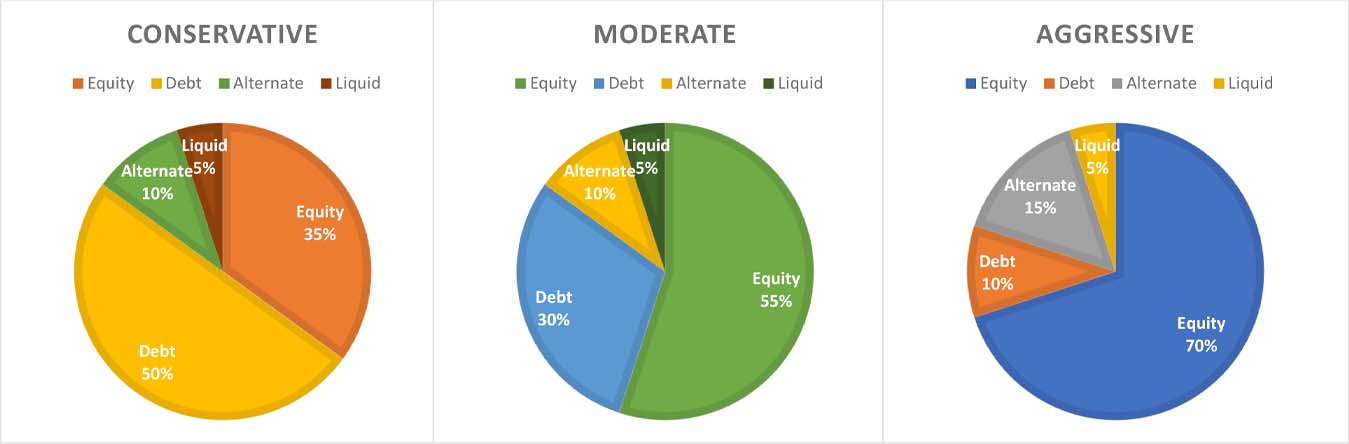

- Adjustment to balance the overall asset allocation

Ideal Asset Allocation

Key discussions which should be done between the client and the RM are:

- What is a good profit worth booking within 1 year/3 years/5 years of time horizon?

- What would be the trigger to exit a fund?

- When would it be appropriate to top up the investment?

- What are the likely events to watch for in a year’s time, in 3 year and 5 years’ time?

Volatile Stock Market for A Decade & More

Times have changed and so has the behaviour of the equity stock market. For the last 12 years, every alternate year there had some big bad news and some big good news coming in. I have a feeling that from the year of 2008 to 2020 it would have been the most volatile period in the history of stock market, since it became relevant. Events like Tulipomania fall, the Great Depression of 1920, IT Bubble of 2000 and so on which impacted the stock market weren’t accompanied with further big news – good or bad as we have been witnessing since 2008. Right now, the cycle of good news-bad news has been creating huge sentiment driven volatility than driven by technical or fundamental analysis/data points.

When the stock market has become so volatile, it calls for regular monitoring of the portfolio. Erstwhile belief of buying the shares and forgetting about them takes a setback in current times. We now need a systematic approach of tracking/monitoring the entire portfolio at regular intervals. That answers our second question whether performance should be monitored at fund level or at a portfolio level.

Coming to our third question: What should be done with the money realised from profit booking?

There are more than 1 ways of handling this money. Some clients choose to open a second bank account and transfer this money into that account. Thereafter client does aggressive investments with this money since it does not risk the original capital. Other clients prefer to reinvest the money into debt funds to ensure profits are safely preserved and used for the financial goal which may be due within a few years. A third set of clients prefer to reinvest into the same funds thereby increasing the total capital investment. As long as the money is preserved well and leads to increase in overall wealth, the proceeds from the profits can be reinvested in any way.

Outrageous Ways To Spend Money

Outrageous Ways To Spend Money

Comments

Powered by Facebook Comments